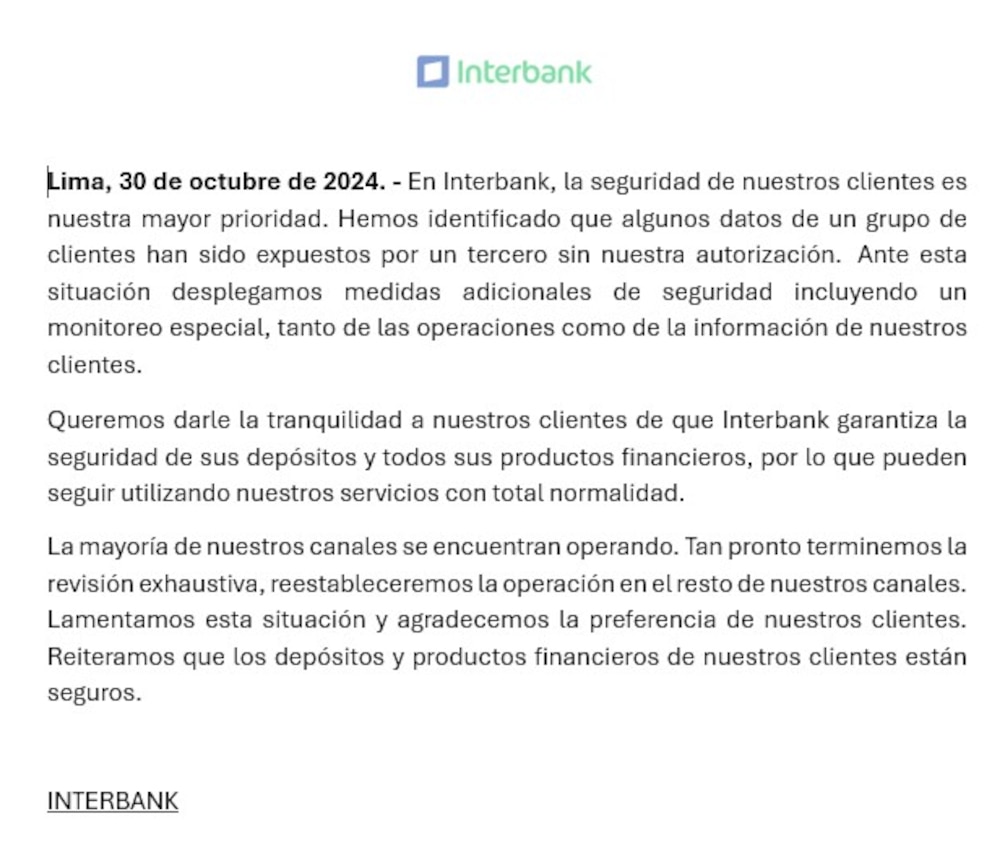

The Peruvian bank Interbank, third in the country in terms of total assets, has been experiencing failures in its customer service and operations systems since October 30th. Yesterday, October 31st, the organization published a statement admitting that it had suffered a cyber attack, during which customer data was accessed. Around 2pm yesterday in Lima, the bank suspended all its operations, returning little by little from 4pm local time. The bank stated in a statement that customer funds are protected and that security measures have been reinforced to ensure the continuity and security of services. The bank has committed to monitoring all operations to preserve the integrity of user information.

According to information received by Ciso Advisor, the bank is a client of three of the four largest consultancies in the world. Interbank highlighted that, after detecting unauthorized access, it activated additional security protocols and intensified monitoring of its operations. The institution reiterated that, despite the incident, customers’ financial resources were not affected and that services are operating normally.

The incident occurred in parallel with technical problems that left many users without access to the Interbank mobile application, which prevented digital transactions from being carried out and affected the Plin digital wallet. During the maintenance period, users reported difficulty accessing their accounts and, in some cases, saw incorrect balances, which generated customer concern.

Among the most affected channels were the mobile application, where users faced glitches and problems with incorrect balances, and the Plin digital wallet, which also experienced interruptions and prevented transfers from being made. Some physical agencies were forced to suspend service due to difficulties in their system temporarily.

Interbank assured customers that it is working to restore the functioning of the platforms fully and asked for understanding for the inconvenience caused. The institution reaffirmed its commitment to data security and the protection of customers’ finances, seeking to reinforce trust and transparency in its operations.

Source: Ciso Advisor