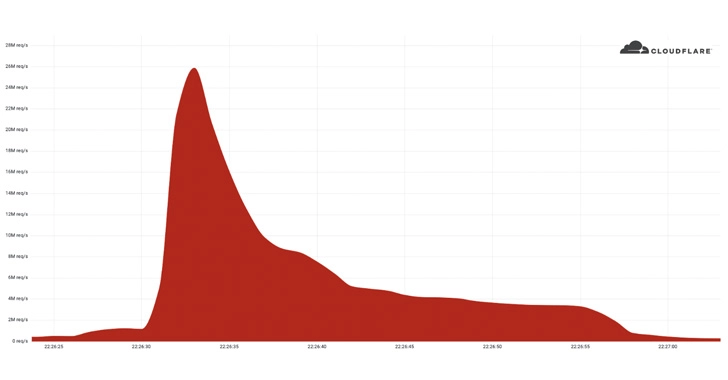

The world of cryptos is waiting for a big bang this week as Bitcoin traders and investors brace for more than 100,000 BTC options valued at about $945 million set to expire on June 26, roughly about 70% of BTCs entire open interest.

These expiring BTC options could bring a tsunami of price volatility, as previous events of such magnitude had caused the market to “swing rapidly” at the size of the bitcoin open interest market expiring.

Data from Skew showed a detailed diagram of the distribution by a strike for this week’s BTC options expiry.

This is the distribution by strike for this week's BTC options expiry. pic.twitter.com/mkAv3l9WMG

— skew (@skewdotcom) June 22, 2020

Bitcoin price pulled back since last month with $10410 remaining below the $9500 mark. BTC whales and professional traders keep buying in the dip, leading crypto experts to question whether BTC whales have something up their sleeves.

However, BTCs open interest doesn’t always predict the direction of market trend; it is certainly possible to gain more insight by studying additional fundamental analysis barometers such as the put/call ratio. Such a fundamental indicator gives a better picture of investors’ sentiment, as call options are often used for bullish strategy.

Data from Skew shows that open interest reached about $1.3 billion, a 100% surge over the last two months. Currently, Panama-based derivatives exchange Deribit accounts for 77% of the options market, although regulated venues such as CME and LedgerX are consistently gaining relevance.

CME is nearly one quarter of #bitcoin options open interest pic.twitter.com/oGFlIht1iK

— skew (@skewdotcom) June 20, 2020

Source: (https://nairametrics.com/)