Budgeting can feel overwhelming, but it doesn’t have to be. While there is no shortage of finance apps, nothing beats the flexibility and power of Excel. In this post, I will go over the practical tips and tricks to help you master budgeting using only Excel.

Whether you’re a beginner just starting or looking to refine your existing finance system, these Excel strategies will help you track your spending, identify areas for savings, and ultimately achieve your financial goals.

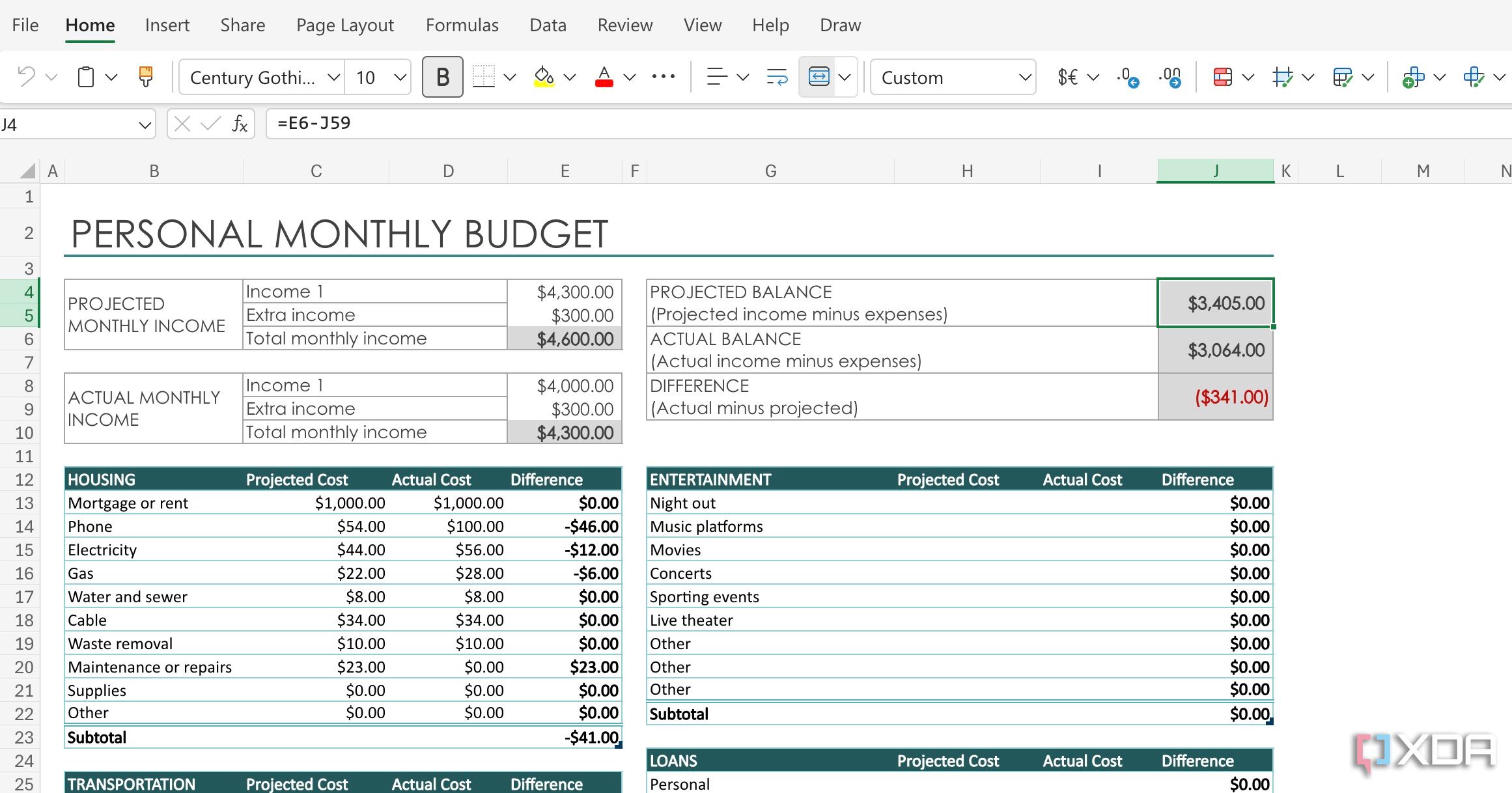

7 Start with a budget template

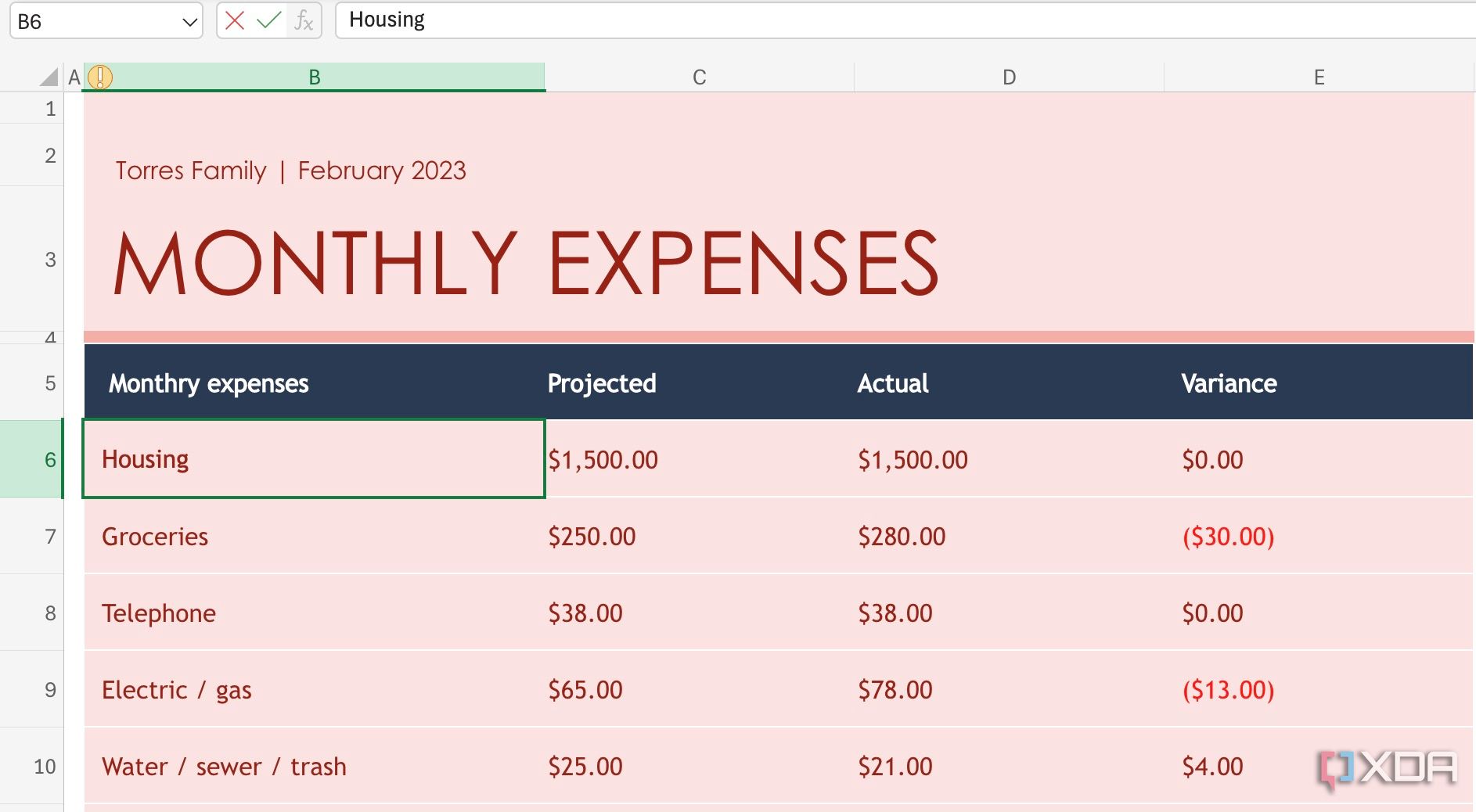

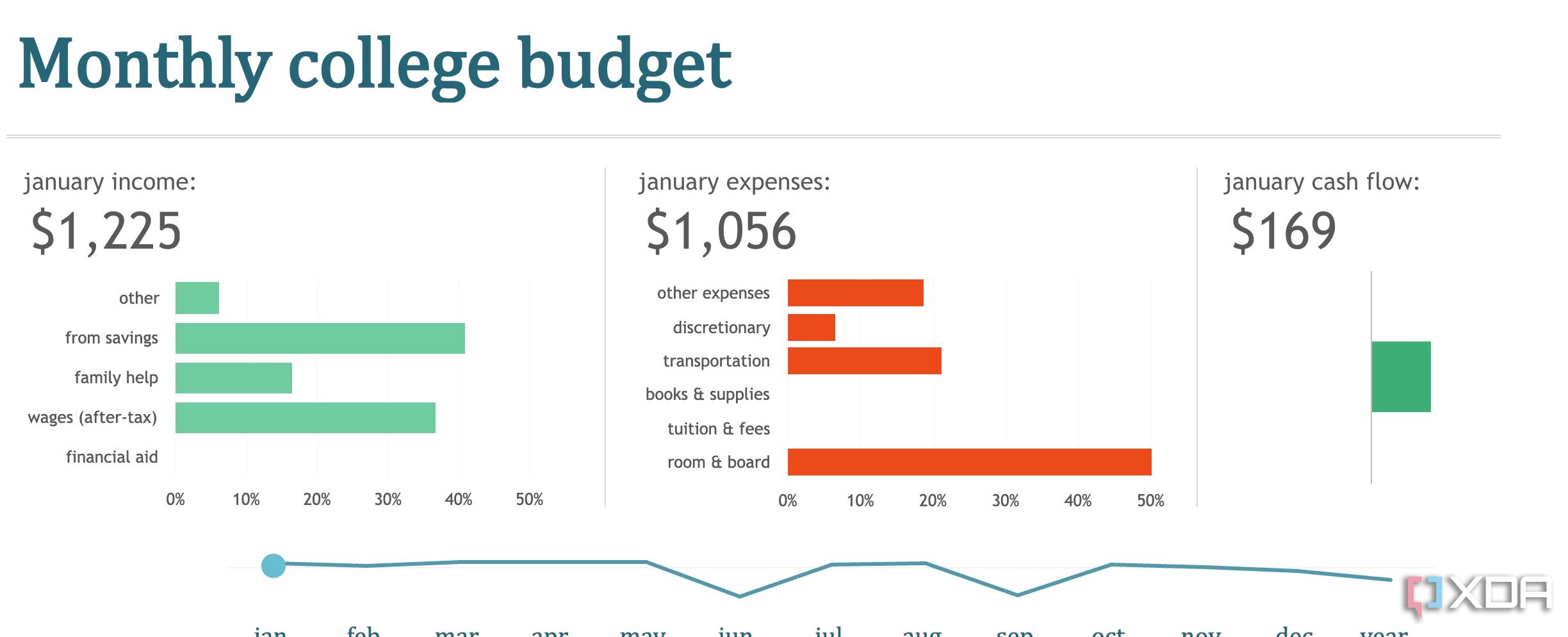

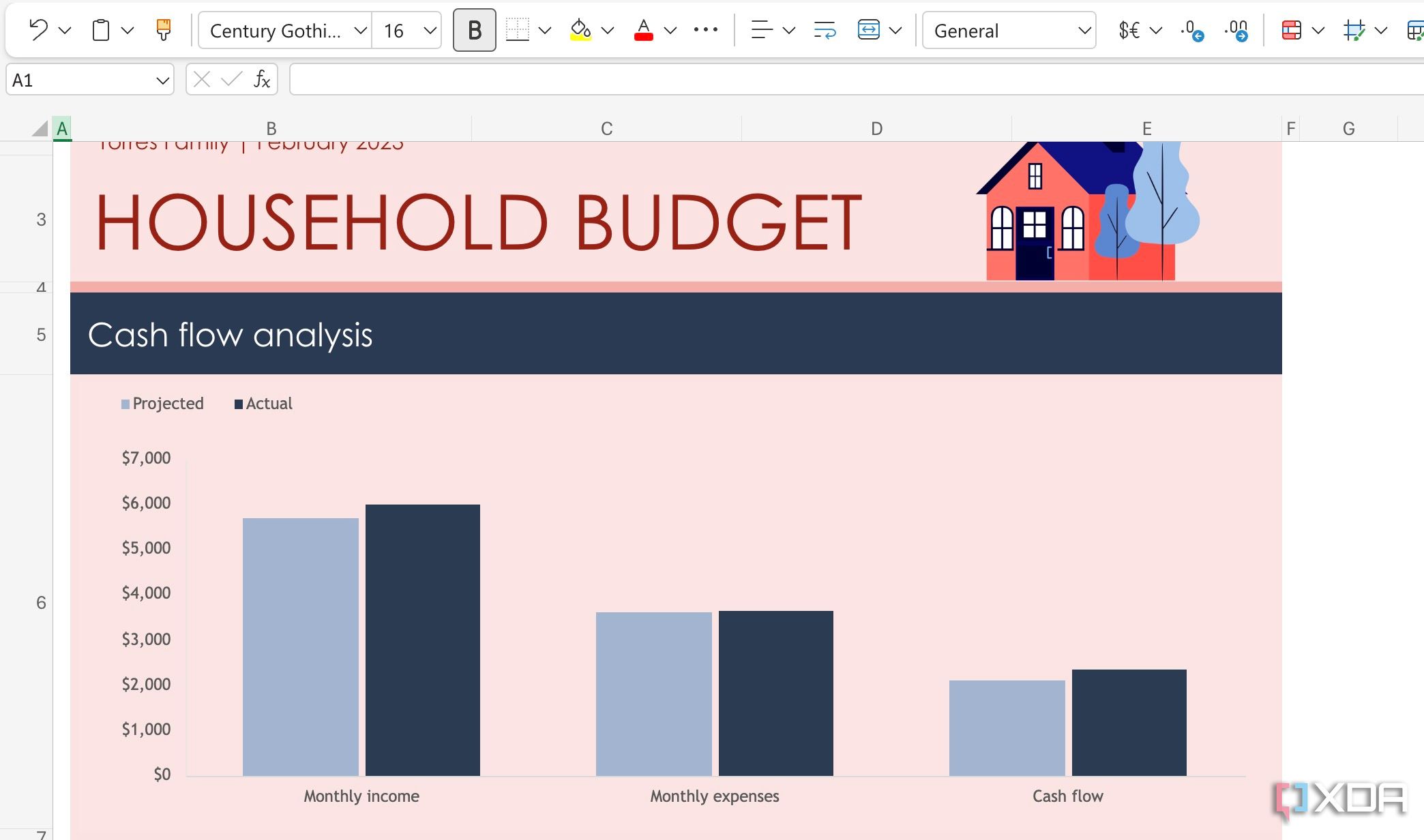

Whether you want to create a personal, household, marketing, wedding, or college budget, there is no shortage of finance templates for Excel. Starting with it can save you significant time and effort compared to building a budget from scratch. Professionals design these templates, and they offer an excellent starting point to beginners.

You can simply copy the template to your account and jump right into entering your financial data. Templates ensure consistency in tracking your finances. They typically have standardized categories and calculations. And, as always, these templates are fully customizable. You can adjust categories, add or remove columns, and modify formulas to suit your specific needs.

6 Use consistent categories with data validation

Your budget workbook in Excel is incomplete without data validation. It lets you control the type of data that can be entered into specific cells. When it comes to budgeting, using data validation for consistent categorization is incredibly important for several reasons.

It prevents typos, inconsistencies, and incorrect entries in your category column. For example, instead of typing Groceries in one row and Grocery in another, you can create a dropdown list with Groceries as the only option.

After all, when your categories are consistent, it becomes much easier to use Excel’s features like SUMIF or Pivot Tables to analyze your spending (more on that later).

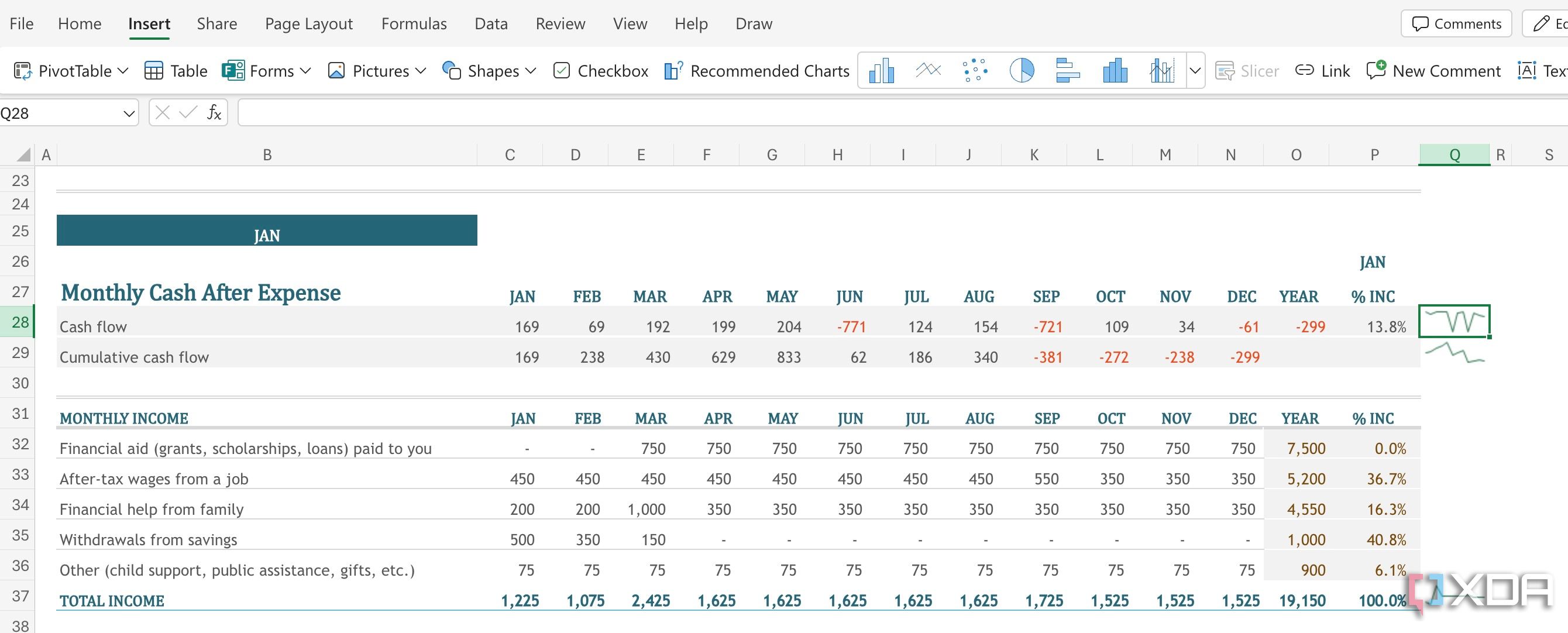

5 Use sparklines to check spending habits

This is optional, but I highly recommend inserting sparklines to check your spending habits. They are tiny charts that fit within a single cell. This can be a fantastic way to quickly visualize spending trends without cluttering your spreadsheet.

4 Visualize your finances with charts and graphs

Here is where Microsoft Excel truly shines. While third-party finance apps also offer charts and graphs, none of them come close to Excel. Once your financial data is neatly organized in columns and rows, use the different chart types to visualize your expense breakdown.

In most cases, you should be completely fine with pie, line, column/bar, and stacked column/bar charts. Advanced users can even go a step ahead by utilizing pivot tables and charts. Let’s say you’re tracking your monthly expenses in Excel. You have columns for Date, Description, Category (e.g., Rent, Groceries, Entertainment), and Amount.

Pivot tables automatically sum up the amounts for each category. For example, you can check if your Entertainment spending has been creeping up over the past few months. The pivot table shows you the exact amounts and confirms the trend.

3 Use separate sheets for summaries and notes

This is another ideal practice for data organization, clarity, and analysis. You can create a main spreadsheet with transactions. It acts as your data entry hub. You can create another summary sheet with pivot tables, charts, and summary calculations. It helps you avoid visual clutter and lets you focus on analyzing finances. Also, add a notes sheet to add context to your budget. You can jot down notes about specific transactions, explain budget variances, record financial goals, and outline your budgeting strategy.

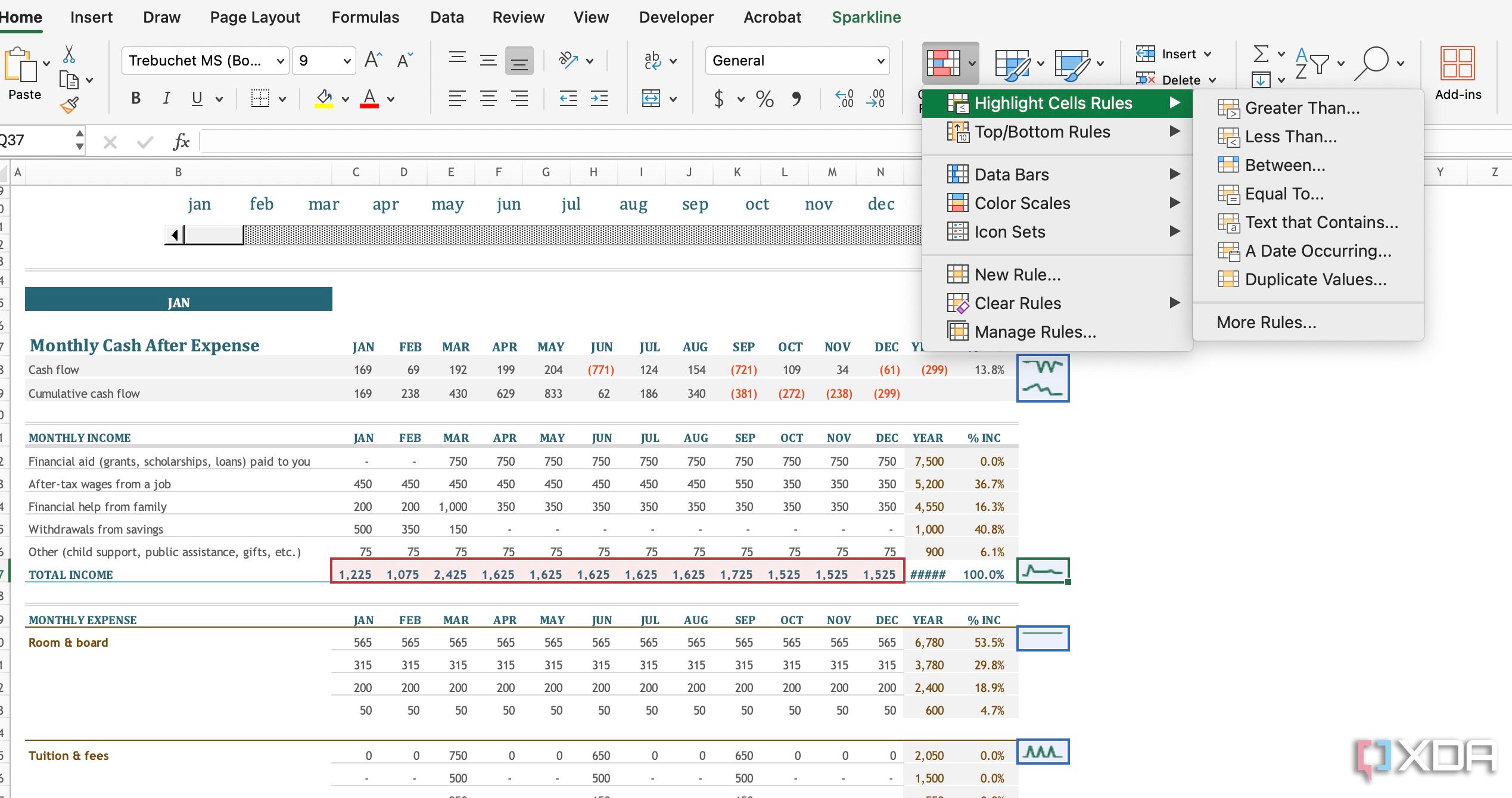

2 Explore conditional formatting

In budget sheets, conditional formatting can be incredibly helpful for highlighting important information. Let’s say you have columns for Category, Budgeted Amount, Actual Amount, and Variance (calculated as Actual Amount – Budgeted Amount). Let’s say you want to quickly identify categories where you have overspent.

1 Utilize Excel formulas

Excel formulas are the backbone of any effective budget sheet. You can automate calculations, analyze your data, and gain valuable insights into your finances. There are dozens of Excel formulas. Among them, you can use SUM, IF, SUMIF, TODAY, VLOOKUP, and more to fly through your calculations.

Let’s say you have a budget sheet where you want to calculate the total amount you spent on “Groceries” in a particular month.

=SUMIF(C2:C10, "Groceries", D2:D10)

The formula above will go through each cell in the range C2:C10. If the cell’s value is “Groceries,” it will add the corresponding value from the D2:D10 range to the sum.

Master your money

Managing your finances using Excel isn’t rocket science. Microsoft’s spreadsheet software offers a wealth of tools to help you manage your money effectively. The tricks above provide a foundation for building a budget that works for you. You shouldn’t be afraid to experiment with different formulas, charts, and layouts to find what best suits your style and financial goals.

With endless numbers and formulas, your budget workbook shouldn’t need to look boring and bland. You can explore these Excel tips to give your spreadsheet a visual makeover.

Source: XDA Developers

Read other news at our blog

In need of a Web Server? Take a look at our services